Deal Abstract

https://www.startengine.com/cityzenith

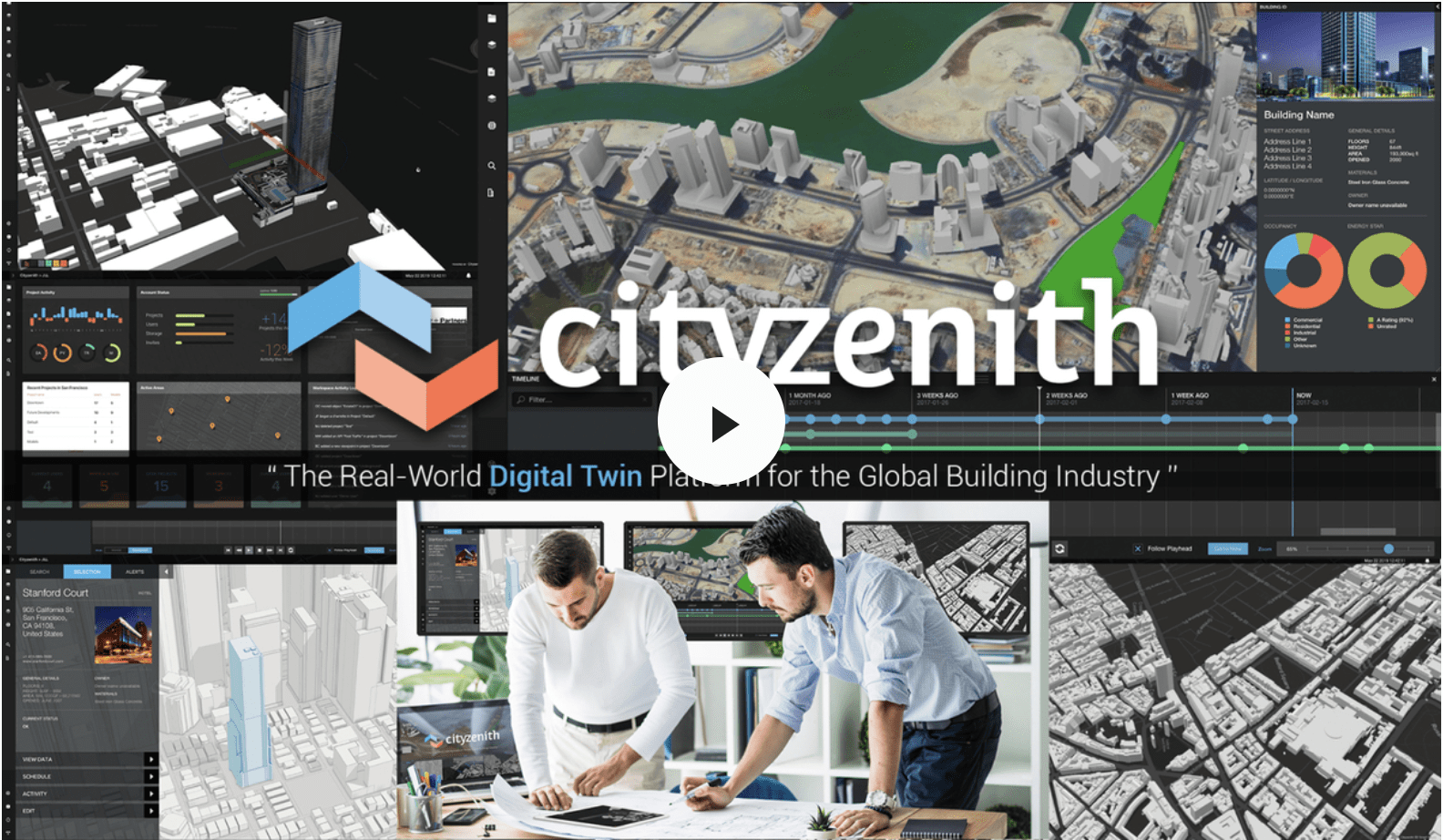

Virtual reality/simulation platform for construction and architects. Revenue stalled in 2019. Company is fascinating in the strange combination of things going right and wrong for it. Investment decision heavily pending on how founder responds to questions.

Although the Company’s revenue decreased in 2019 as compared to 2018 from $182,632 to $152,018, the Company anticipates that revenue in the fiscal year 2020 will grow and will continue to grow. This is based upon a tripling of new contracts in 2019 and a growing market acceptance of our products, increased brand and product recognition and expanded marketing efforts. There is no assurance that the Company or its products will be accepted as anticipated or that the Company will gain market share as targeted.

Cityzenith Circular Offering

Shoutout to Bob for the tip!

Interested in startup investing? Subscribe to my premium newsletter, Startup Investing, to receive weekly content, exclusively tailored to accompany investors in their venture journey.

Decision

Pass

Why Investing/Passing

- Valuation Sketchiness: Is it $16.3M? $25M? $7M? Not worth wasting my time to validate someone who is not being completely translucent with numbers.

- No Response From My Network: Did not get confirmation from my network about anything related to this product or industry.

- Discouraging Investor Response: Founder didn’t answer any of my questions directly.

The 6 Calacanis Characteristics (91 161 18)

| Check | Yes/No |

| 1. A startup that is based in SV | No: Chicago, IL |

| 2. Has at least 2 founders | No: 1 |

| 3. Has product in the market | Yes |

| 4. 6 months of continuous user growth or 6 months of revenue. | No: Revenue dropped from 182k (2018) to 152k (2019.) |

| 5. Notable investors? | No: Surprisingly, given that the founder previously raised $10M from Sequoia Capital India for a 500 person company. |

| 6. Post-funding, will have 18 months of runway | No: 2019 burn was 1.2MM (which was improved from 2.1MM 2018 burn), currently at six months. Raising the minimum $1MM will give 10 months of runway, though the company is capping fundraising to $20MM. |

Although the Company’s revenue decreased in 2019 as compared to 2018 from $182,632 to $152,018, the Company anticipates that revenue in the fiscal year 2020 will grow and will continue to grow. This is based upon a tripling of new contracts in 2019 and a growing market acceptance of our products, increased brand and product recognition and expanded marketing efforts. There is no assurance that the Company or its products will be accepted as anticipated or that the Company will gain market share as targeted.

Cityzenith Circular Offering

The 7 Thiel Questions (ETMPDDS)

- The Engineering question:

- Possibly: It’s a technology company, and though I don’t know much about the company, it seems plausible.

- The Timing question:

- Fine: Good time to build SaaS.

- The monopoly question:

- Good: Could scale quickly, though I don’t know enough about the different tools (GIS, etc.) to know if it replaces or it just interfaces with them.

- The people question:

- Good: CEO strong, want to know if the CTO is the one who did Google Earth.

- The distribution question:

- Hard to Tell: Going to ask who is the chief decision maker in an org who is buying.

- The durability question:

- Good: if successful, very defensible.

- *What is the hopeful secret?:

- No one was deploying the capital in a software-first way to define construction in 2020.

What has to go right for the startup to return money on investment:

- 1000x Revenue: In April 2020, valuations for SaaS companies was ‘the median public SaaS company valuation multiple stands at 8.2 times ARR.‘ In other words, for a company to be worth $1 billion, it must have around $100 million in annual recurring revenue. Zoom achieved $100 million in ARR and unicorn status in 2017.

- Build a Successful B2B Sales Team: Need to know who is the decision maker at construction companies and what are the specific pain points they are trying to solve by buying this product.

- Learn from 2019’s Decrease in Revenue: Enough said. 2020 has a pandemic so that adds in even more uncertainy.

What the Risks Are

- Revenue Doesn’t Rebound: What did we learn from 2019? The quote at the top is not promising.

- Management and Spending: Spending $7MM to get $182k in revenue is not promising. Also, why not get more institutional money in to help get more legitimacy for B2B sales?

- Not Enough Customers to Reach $100M in ARR: “SmartWorldPro stand alone Digital Twin implementations are priced based on scope and start at $50,000 on up to 100’s of $1,000s. Custom SmartWorldPro enterprise-wide licenses begin at $1,000,000.” This means selling to 100 custom enterprise-wide licenses, or 2000 for the $50k license.

Muhan’s Bonus Notes

This company is fascinating because of how weird it is. Outstanding questions:

- Why has the founder gone the crowdfunding route instead of raising from an institutional investor like Sequoia, given he’s done it before?

- Why is this round unpriced? If a company raised $7MM and didn’t have a multiple on how much value add (e.g. raised $7MM and is worth $25MM,) that strikes me as concerning.

- What’s going on with the drama of the person who asked the question in the comments section?

- I’m going to ask my commercial real estate investor friend if he has ever heard of this company.

- Why did revenue drop in 2019? What is the key learning we’ve taken away from this dip?

- What is the name of the person who is the decision maker in a firm that purchases this software?

Financials (References)

- Current Fundraised: $427k

- Valuation: ~7MM

Updates

This is where I’ll post updates about the company. This way all my notes from offering to post-offering updates will be on one page. Also, somewhat of a dearth of materials (whose the team? where are the comments? why are the financials so opaque?)